A major Fintech vendor witnesses 33% improvement in usability issues using Affogata's User Insights Platform.

Customer intelligence platform recommended prioritization of product bugs and defects, enabling Q2 improvement of customer experience.

Overview

A leading private Fintech company, with more than 8 million subscribers, recorded major product improvements in 2021 by focusing on a lean process of gathering customer feedback from the open web through Affogata’s Product Enablement platform. Gains, for this digital micro-investing company, were spotted in several different verticals after Affogata’s AI turned the company’s unstructured negative feedback into specific categories for the brand’s product team to prioritize nimbly on its product roadmap.

Challenge: address increase in clients’ complaints and avoid churn

The Fintech company, while growing its customer base, has experienced an increase in its clients' online complaints and negative mentions. Major usability issues of the company’s interface were noticed and reported by many subscribers. As a result, the company’s KPIs (key performance indicators), such as user signups, churn rate, and revenues, were suffering. Clients were complaining about different bugs, not being able to access the platform, and customer service problems, among other things. Their complaints were recorded over multiple online channels, such as IOS (iPhone operating system), GP (Google Play), special forums such as Reddit, and on different social media platforms. Those various problem areas, reported over multiple platforms, decreased the company’s customer retention and revenues. The peak in the negative conversations over product and service has also made it very difficult for the company to manage, because of the multitudes of problems recorded from large amounts of customers and on many different platforms.

Action: structuring the data by using Affogata’s Product Enablement Platform

Affogata’s Product Enablement platform was employed by the Fintech company in order to help resolve those problems. The platform collected thousands of customer feedback data points and analyzed them, concentrating on those mentions which were negative. It then structured all of the complaints into specific categories, showing the volume in each of them and giving the company actionable insights, prioritization advice as well as other recommendations of what to do next. The company took action to fix the problems and address customers directly. They were able to respond to customers from whatever online media on Affogata’s “all-encompassing platform”, showing their care for them.

Results: improvements on all levels

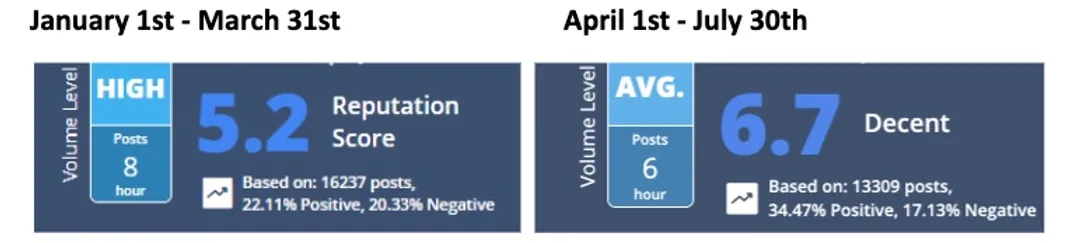

As a result of taking specific actions which were based on Affoghata’s findings and recommendations, the company registered improvements on different important fronts. Reduction in negative mentions contributed to the overall brand reputation, which stood at 5.2 on Q1 and improved by a third to a 6.7 score on Q2.

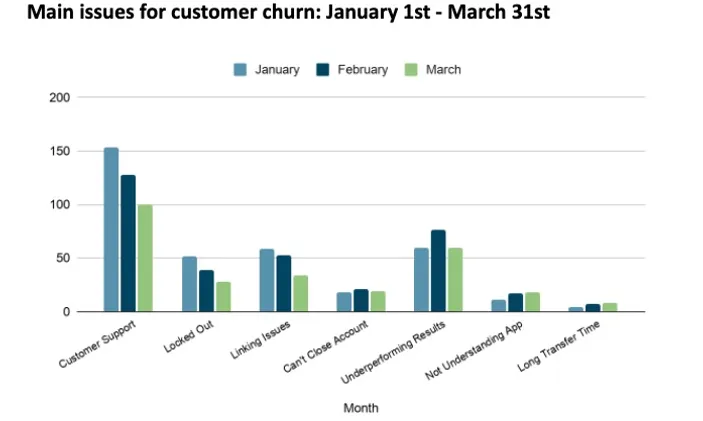

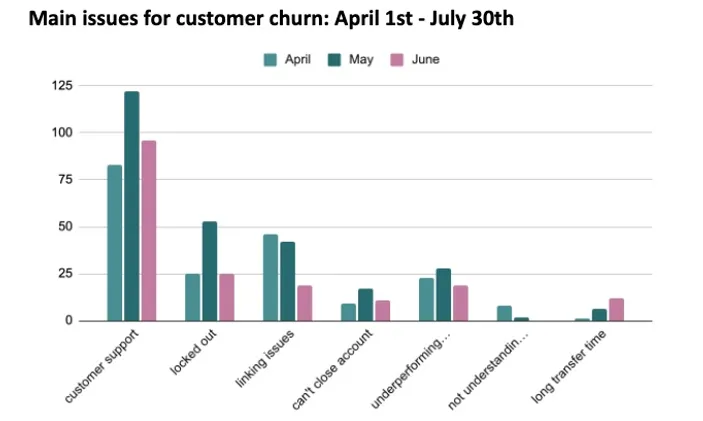

As for the complaints categories, they all registered improvements and as result, saw the number of negative mentions decrease considerably. Poor customer support, for example, the number one complaint category, took a much-welcomed downturn from 370 in Q1 to 290 in Q2.

Another major problem area was the "Locked out" complaint, where people reported their inability to access the platform. The company’s product team was able to prioritize the severity of this bug and fixed it immediately through an agile process. This category actually saw a January-to-February-to-March fall with a January peak of around 50 negative mentions. Q2 recorded April and June with 25 specific complaints each while the month of May surprised with a spike of a little over 50 negative mentions.

While handling its problem areas, the Fintech company received some good news from Affogata as two other categories posted positive results. "The $5 campaign"' which called the Fintech platform members to recruit their friends with a guaranteed $5 for each new member joining in, collected 1162 referrals in Q2 for a nice 25.37% out of all positive mentions. Another positive feature balancing the company’s overall brand sentiment was the "Long-time user delight", by which long-time customers noted in surprise just how much money they saved without noticing. 97 positive mentions were recorded here for a 2.1% contribution to all of the Q2 positive mentions. Overall, quick action employing Affogata in collecting and analyzing customer sentiment led to quick product and service fixes by the company. The company’s fast actions then led to major improvements for their customers, which in return yielded much fewer complaints and an improved brand sentiment score. Finally, Affogata supplied the company with competitors' data, meaning analysis of what customers say about the company’s rivals all over the open web. That enabled the company to better understand its position in the market.

Summary

Affogata's Product Enablement platform analysis helped the Fintech leader structure its main usability issues as well as distinguish between the more urgent ones and the less problematic issues. The company’s product changes derived from the various Affogata insights that led the company to allocate the necessary resources in order to solve its pain points and improve its service. As a result, the main KPIs used to gauge the success of a product increased significantly such as customer churn rate, user signups, and consequently, product revenue.