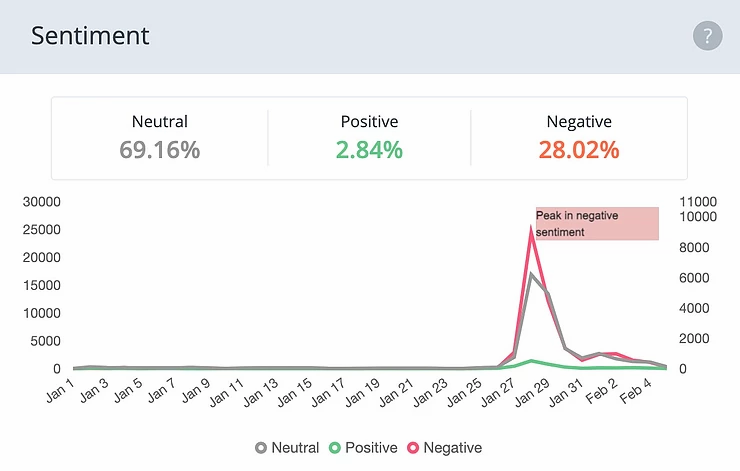

Robinhood’s sentiment as recorded on Affogata. Extremely negative sentiment affirms users’ rage

Robinhood claims innocence

For a while, Robinhood became the focus of conspiracy theories that it was forced into ceasing trade by the hedge fund Citadel. Citadel owns the market maker Citadel Securities, which buys Robinhood’s orders flow, and it was facing a huge loss on the GameStop shares it was trying to shortsell.

Robinhood CEO Vlad Tenev insisted that the real reason for suspending GameStop trading was because of clearing house regulations. Indeed, trading platform Webull also briefly suspended GameStop trades, but for a shorter period of time than Robinhood. Other trading platforms like TD Ameritrade and Charles Schwab who, like Robinhood, use their own clearing houses, didn’t have to suspend trade at all, so many people hold fast to their conspiracy theories.

Robinhood relies on its merry users

The combination of a purposeful community, equipped with “means of mass-trade” like Robinhood, suggests there’s a new world order. A community of amateur traders who buy or sell only fractions of stocks can set off a tsunami that is able to squeeze the most sophisticated hedge funds into huge losses, just through power of a thread.

Fintech companies like Robinhood have suddenly discovered that they are stuck between the “Wolves of Wall Street” and the millennials who actually make up their user-base. Up until now, they may have felt that the former held all the power, but the GameStop incident revealed that their reputation and revenues lie in the hands of the latter.

Robinhood might argue that they did the right thing by restricting the trade of $GME, and even claim that they had no choice but to abide by clearing house regulations. But their community definitely does not buy that argument and is willing to punish them for it.

We can’t help but wonder whether Robinhood would have managed the crisis any differently if they had been tuned in to user sentiment, as expressed across the relevant Reddit communities. Using a tool like Affogata, which could help Robinhood tap into community sentiment and provide ongoing real-time insights, make a huge difference to companies that suddenly find themselves at the center of a brewing crisis. Even if Robinhood ultimately made the same decision, they may have communicated it differently had they known about their community’s sentiment, and thus avoided the flood of negativity.

Even fintech platforms need to keep on top of user sentiment

Fintech brands can and should use community insights to guide their policy decisions and communications, determine which features to promote and which to remove, measure their SLA, and understand how viewers respond to their social media presence. The GameStop incident showed just how crucial this is for Fintech platforms. Without real-time understanding of user sentiment and its impact on reputation and brand, managing a crisis like this is nearly impossible, and certainly much more difficult than it needs to be.

Learn more about our sentiment discovery and customer intelligence platform: get a demo here