The lockdowns, the lack of sports, and the amount of time in our hands superfed the rise of new accounts from individual investors on trading and online brokerage platforms. With Affogata, you can gather all data from the open web and connect the dots between where people – especially Millennials – are present in the open web, with the new financing world. Affogata’s AI is tracking all trending topics and conversations around the Fintech and Cryptocurrency world and these are the latest insights.

Cryptocurrency is increasingly becoming more mainstream

According to Affogata, the recent peak in conversation from the stock market and cryptocurrency is about the crypto-friendly bank backed by Warren Buffett’s Berkshire Hathaway that plans a $2 Billion IPO on Nasdaq.

Up until recently, owning cryptocurrency was not considered part of the mainstream economy and these kinds of investments and transactions were mostly considered to be used for the black market. However, with recent events such as Coinbase – a platform used for buying and selling cryptos – became public on the U.S market in April or the Brazilian bank backed by Warren Buffett planning such a big IPO are milestones that play a significant role in the industry.

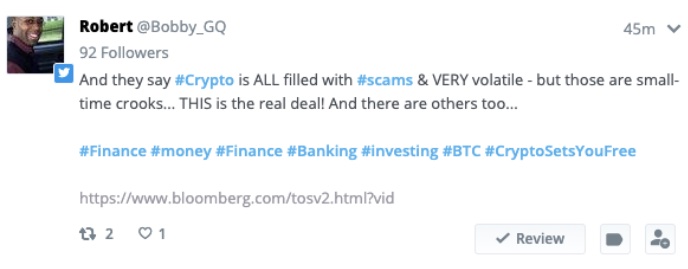

Affogata’s AI discovered that not long ago, people were discussing the fact that cryptocurrency was filled with scams and could be extremely volatile, but the participation of big banks and investors creates more stability and appeal towards the industry. Tracking certain topics and keywords and being integrated to several platforms such as Redditt, enables Affogata to track all conversations and sentiment around the multiple topics:

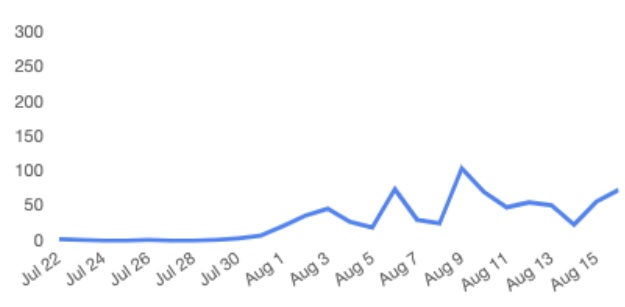

From July 1st until July 28th, there were approximately 500 mentions on the open web around the topics of the stock market and cryptocurrency, while from July 29th until today, there are around 55,500 mentions. The conversation is mainly neutral, however, positive (8,435) mentions are predominant over negative ones (2,789).

People are talking about how investing in cryptocurrency is a better investment than in stocks lately:

The new Fintech movement

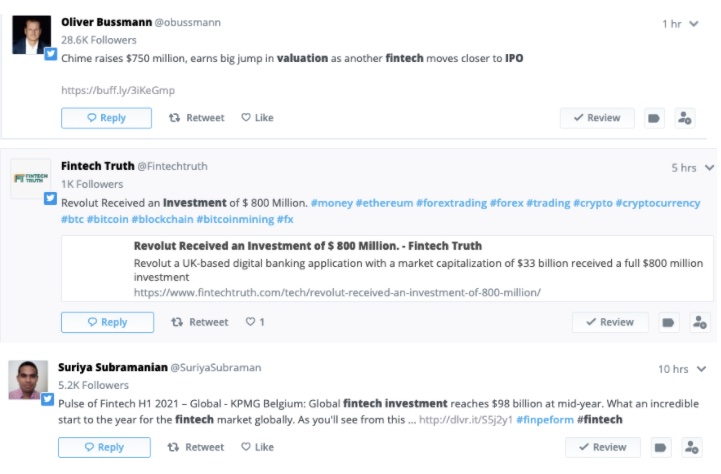

The Fintech movement kicked in fast in 2020 driven by the COVID lockdowns giving a rise to all digital finance models. There was a massive increase in the valuation of Fintech companies and in 2021, we expect this movement to keep evolving and accelerate even more the growth of the industry. The conversation on the open web describes in awe what’s happening with these companies and the big jumps in valuation with brands such as Chime and Revolut:

The US and Europe were the main markets in the evolution of these Fintech companies, However, as the industry is expanding, more platforms are developing in other parts of the world, such as in Latin America. Latin America is a place where not a lot of people can afford to have bank accounts, but there is so much possibility. Now, with the fact that you need a credit card for every transaction, people in Latin America are stuck with the fact that without a bank account, you cannot have a credit card.

The introduction of Uala in Argentina

Ualá provides various financial services connected to a prepaid card and works via a mobile app. The company has issued more than 2.5 million cards in Argentina since launching in 2017. They recently received a $350 million investment from Tencent, increasing the company’s valuation to $2.45 billion. The biggest Unicorn in Argentina.

In summary

“The pandemic drove a 15 percent spike in Fintech app use during 2020, with 4.6 billion downloads as consumers sought to take control of their finances amid the uncertainty.” It is clear that with these adoption transformations, companies should be prepared to adapt to all of these changes in consumer behavior and be part of the shift.

It’s crucial for brands to track all the conversations online around any kind of investment trends that they could tap into. Moreover, when it comes to trading money, PR crises become 10 times more sensitive. It is important for Fintech and Cryptocurrency platforms to have a system in place to prevent these types of crises in advance, or have a strategy to minimize them once they happen. Platforms such as Affogata define where the company is being affected, what networks, in which countries they are being cited, or if influential people are mentioning them and help consequently, improve their brand reputation.

Lastly, customer experience and product teams use platforms such as Affogata to understand how people use their app or platform and make sure that people know what they are doing. It’s important for trading companies to be responsible for educating the people on how to invest their money. Therefore, it’s crucial to have a platform in place to use as a testing ground to see if users are taking advantage of their resources and to understand if they are getting enough information about the basics of investment.